On Monday, 20th of January 2014 Buni space in cooperation with the Mobile Monday team organized a Mobile Monday session with the theme “Status of Mobile and Online Payment in Tanzania”

The facts of Mobile Payment systems in Tanzania, opening the discussion during the session, Vodacom Tanzania Head of e-commerce operations Mr. Franklin Bagalla talked about the scope and the opportunities that comes with the mobile payment systems in Tanzania and the necessity of the systems. Mr. Bagalla shared the story of M-Pesa Tanzania and how they are changing lives. According to him M-Pesa is all over Tanzania and it has been among the major sources of financial inclusion, giving the poor the opportunity to be involved in the formal financial sector of Tanzania. He believes with all the opportunities that comes with mobile money we should be able to exploit more by creating a “cashless society”. He talked about the future plan of M-Pesa, which is, to give values to the users to make them be able to purchase not only consumer services but also commodities with their mobile phones.

The statistics shows, mobile money have created jobs to thousands of Tanzanians who got commissions by transforming cash into digital values. The so called “wakala” the merchants are believed to be the most important group in the mobile money systems value chain, according to Mr. Bagalla.

|

| Audience of the Mobile Monday Dar session last Monday listening to the speaker at Buni Space. |

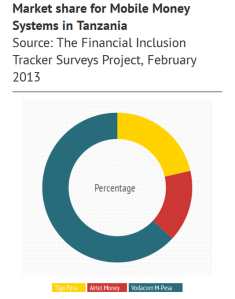

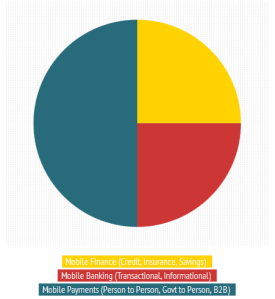

The challenges, one of the biggest challenge so far was getting the mobile service companies to interact and work with local developers to create more values to the mobile money systems. Mr. Bagalla agreed on this, he said, we haven’t yet utilized mobile money systems to its potential as per my presentation (article writer) on three possible opportunities in any mobile payments system (Mobile Finance, Mobile Payment and Mobile Banking). Most of the mobile money users in Tanzania use mobile money for only making payment for services and checking banking transactional records. There is still a lot of opportunities from the industry to create business in stuffs like savings, insurance and credit. Even though there was a tough discussion on the willingness of the mobile companies to work with startups companies to achieve this. Individuals from the meeting complained most of digital business and online transaction systems in Tanzania fails due to lack of support from the mobile companies. Some individuals questions, if there was a conflict of interests between banks, mobile companies and local entrepreneurs and how they can work together to increase efficiency and productivity.

The future of Mobile Money in Tanzania, Mr.Gustav Vermaas, Managing Director of Smart Banking Solutions Limited Company explained, according to him he does not see any competition in the mobile money business in Tanzania, the only competition is between the digital money solutions against cash ownership culture of Tanzanians. He said the market is still vast for any new incumbent on the business to exploit. Smart banking solutions companies are coming with their smart cards that will allow individuals to pay and purchase almost anything from the market and creating the cashless society in few years to come. He explained about their pilot projects and the success stories and how they are going to expand their business. The audience was eager to know how will the company be able to change the culture of the people, he asked if people can share experience few years ago when mobile money was starting to get attention from developing countries and compare with the current situation and finishing by saying, “anything is possible”.

The session ended by application demos from Benedict Tesha, Jamaa Technologies showcasing his application, Jamaa Pay and Eric Mutta talking about Minishop systemthe product to help local SMEs and businesses to track records and improve efficiency. it was another great Mobile Monday session.